A funny thing about innovation…

There’s a funny thing about innovation, especially when we are talking about processes and the way things are organized within a business.

Processes tend to get embedded, especially if they are set up by people who are experienced in their field and who are long term employees. It’s really good that essential business processes are done in a consistent way that everyone understands and which produce repeatable results, time and again.

However…

The problem with this is that frequently, there’s little consideration given over to how things can be improved. A couple of mantras spring to mind which support this and help to embed the attitude that you’d be best leaving some things well alone:

- If it ain't broke, don't fix it...

- That's the way things get done around here

Accepted practice for invoice payment

One of the things that is often ring-fenced by this attitude is the way businesses accept payments for their larger invoices, such as fees for professional services or for project work.

The conventional practice is to issue invoices and await payment. There may be pre-agreed terms such as payment on 30 days or month end, also known as net30. However, the problem with these types of ‘push’ payment arrangements is that many of us know the checks or bank transfers may not arrive at the agreed time.

This creates cost and work in chasing payment and impacts cash flow and working capital management. On the whole, it can be pretty unsatisfactory for the people that run the finance or collections department.

‘Pull’ payments offer an alternative and over the years, a few new ways to pay have come on the scene. Card payments on some of the newer payment processing platforms, such as Stripe, offer significant advantages over conventional payment gateways, particularly the cost.

And there’s always PayPal or other payment gateways, which could be options. These may have their pros and cons, however there are also a couple of other alternatives worth considering.

1. Debt Factoring

Debt factoring is also known as invoice or accounts receivable factoring. Essentially, a business sells its accounts receivable book of invoices at a discount to a third party, known as a ‘factor’. The factor pays immediately so you get cash in-flows straight into your business, and all the good things that might flow from that. However, the costs (in the shape of the discounted price you sell the receivables book at) is higher than bank financing. All in all, there are other disadvantages, and any decision about choosing to factor needs to be carefully weighed up.

2. Payment plans

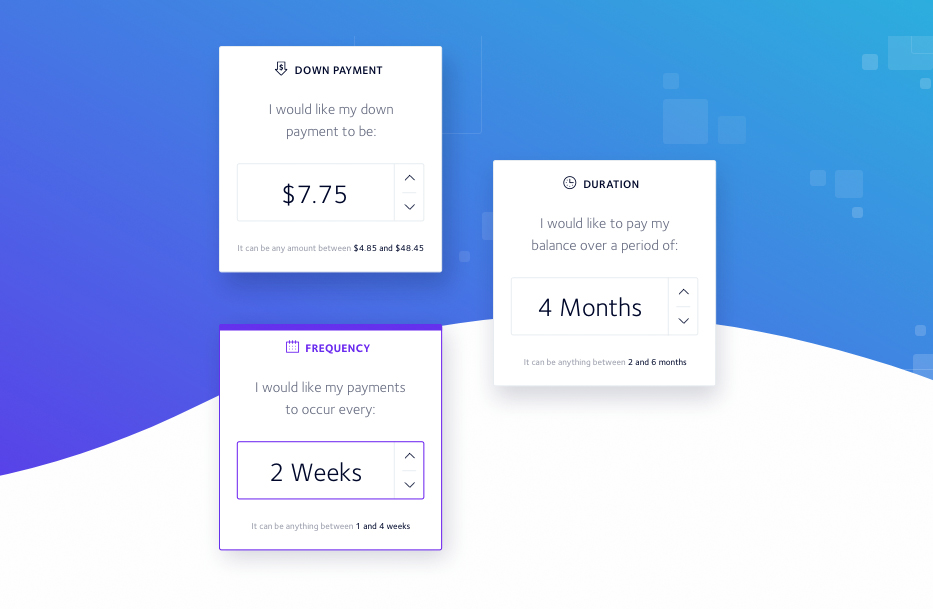

It’s much easier to elect to offer your customers payment plans. This is a good way to schedule installment payments with customers that owe you money. With Partial.ly’s payment plan software you can offer plans, agree schedules and automate payments.

Your cash arrives in the bank when you expect it, allowing you to actively plan for predictable cash flow. With this comes the ability to use working capital management to leverage your positive balances and get your money working harder.

Agree payment schedules and automate payments with Partial.ly

Why not innovate and shake up how your clients settle their invoices with Partial.ly? It costs nothing to set up and we only get paid when we do our job of processing payment plan payments. For your customers, it’s paying those big bills, and for you it’s collecting payments, both made as painless and frictionless as possible.

Click here to sign up and let Partial.ly simplify your invoicing and collections process.