Why do you issue big bills?

Ok, so you're a type of business that issues invoices to your customers for sizeable amounts. The customers or clients you invoice might be other businesses, or they might be personal bills to individuals for products and or services.

Examples could include:

- Medical, legal or accountancy fees

- Architecture or construction fees for home owners and commercial projects

- Home improvement supply and installation - HVAC, kitchens, bathrooms etc.

- Education fees for adult education, university, college and continuing education

- Leisure travel packages or ticketing and reservations for special events

You issue the invoice with standard payment terms, or sometimes you might negotiate them with special conditions such as shorter payment terms. Whatever they might be, you are expecting payment by a specific date.

The late push payment vicious circle

The date of the payment is a key component that structures the cash inflows and outflows of your business. Often, you need the cash to be paid so that you can maintain positive cash balances at the bank and have sufficient working capital to run your business smoothly, efficiently and effectively.

Late payments create delays to planned business operations, slow the tempo of business and completion and payment for other work, may delay employee salary or contract worker payments, or cost you dearly for using bank financing. All things considered, late payment using methods where the debtor pushes the cash by manual transaction, can be a bit of a vicious circle that really hampers growth and profitability.

The reasons for late payment can be complex. Perhaps the invoice is still being processed by the accounts receivable..... or they made a mistake with the payment date..... or the bank messed up the payment.

Or it might be the company or individual has been the victim of late payment..... and it seems the vicious circle is actually a mesh of interlocking gear rings where the pain and burden is transferred where ever companies or people that are affected interact.

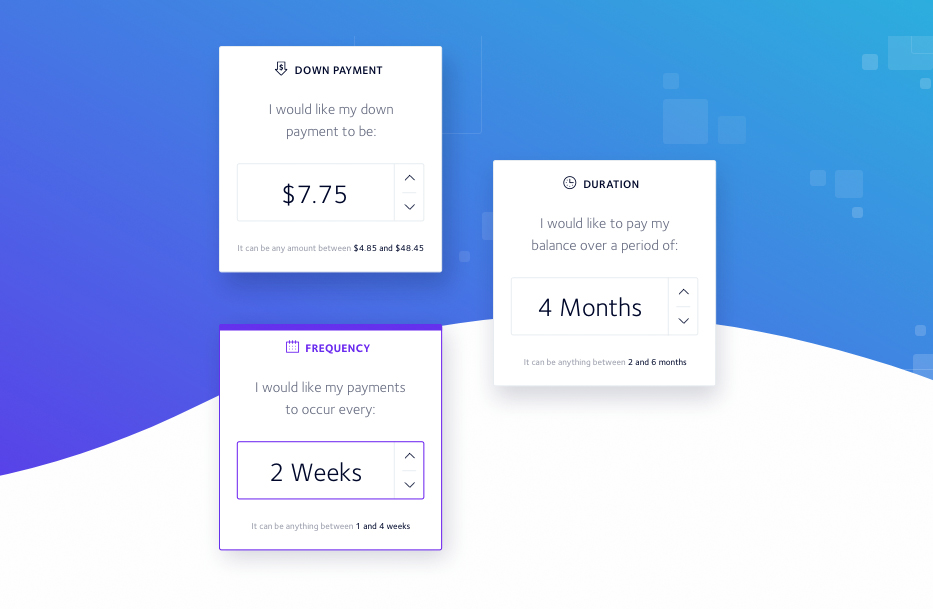

Automated, agreed payment with Partial.ly

Now, there's a better way to collect payment for big bills to B2B and personal customers and clients. Offer your customers the option to settle their large invoices with payment plans. Partial.ly Payment Plan software allows you to offer plans, set amounts, agree schedules and automate payments.

Automated payments pull the cash directly to you. Your cash arrives in the bank when you expect it, allowing you to execute your business operations in line with the cash flow you have predicted. Any dependencies for cash to fund other work streams are satisfied and all the other negative things that result from late payment are eliminated.

Partial.ly costs nothing to set up. There's no credit card required. Our pricing is transparent and we only receive payment when we have done our job of processing automated payment plan payments.

Break the vicious circle of late push payment for big B2B and personal bills. For your customers or clients, it's paying those big bills, and for you it's collecting payments, both made as painless and frictionless as possible.