With Partial.ly’s flexible payment plan software, convert hesitant customers into confident buyers by offering customized payment offers that work for your business.

You may be wondering, "What payment terms will work best for my business?" This article explores what an offer is and provides insight into creating effective offers that attract customers and help drive your business's success.

What is an Offer?

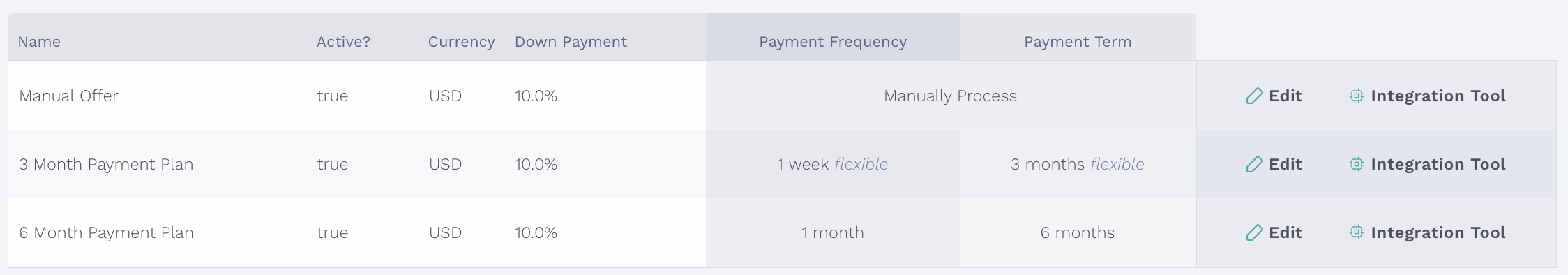

A payment plan offer serves as a reusable template with preset terms. You can use an offer to open multiple payment plans, saving you time and ensuring consistency. The customizable terms consist of:

- Down Payment: the amount required to open the plan

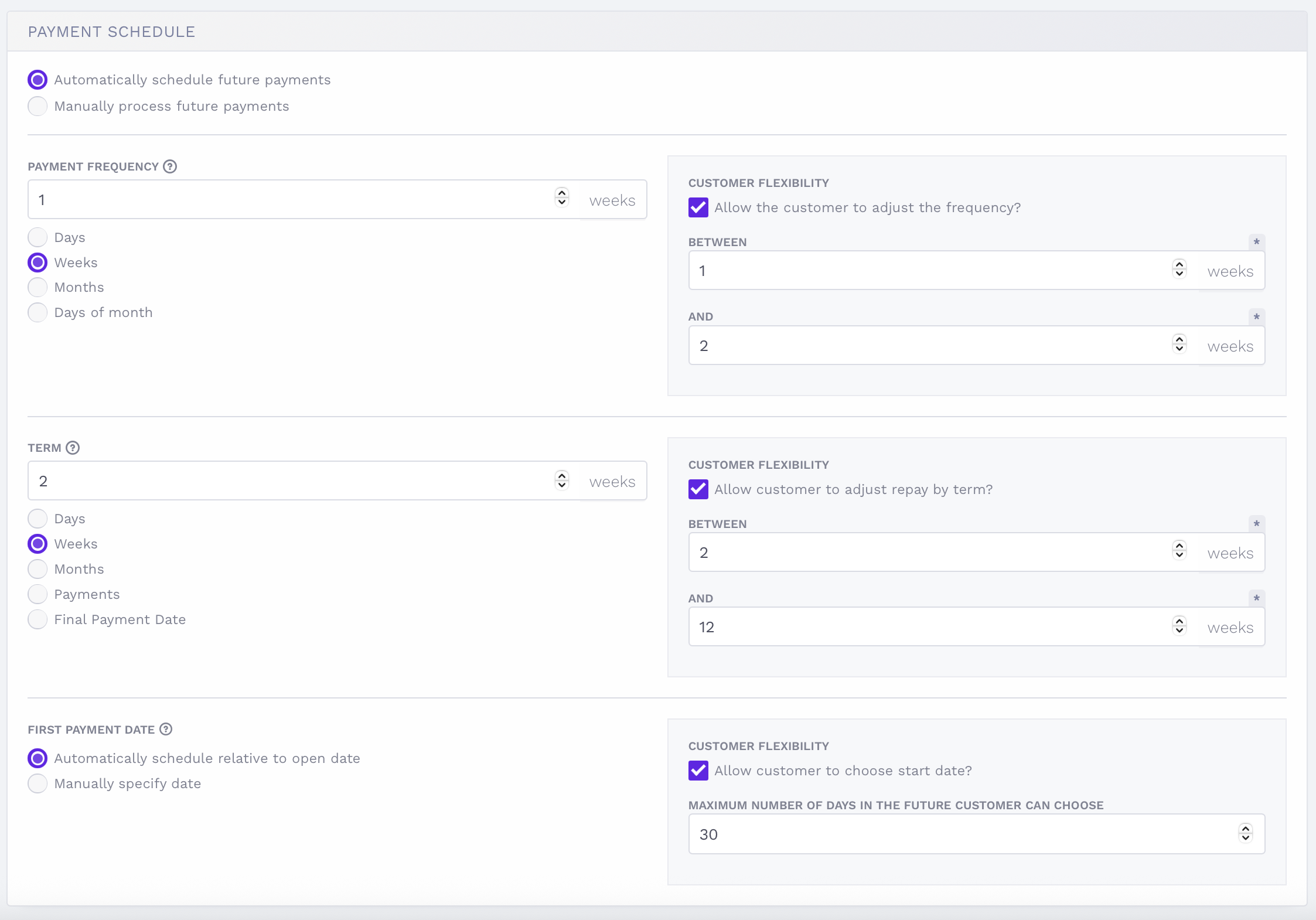

- Payment Frequency: how often a payment is processed

- Term Length: how long the plan will last

Once a plan is opened with your offer, our platform will automatically process payments according to the terms, creating a hassle-free payment processing experience.

How to Use Payment Offers to Boost Sales

You can implement payment offers in multiple ways to reach your audience:

- 🌐 Add offers to your website

- 📩 Share offer links on social media or via email

- 📱 Print scannable QR codes for in-store displays or printed marketing materials

You can use just one offer, or create multiple ones to use for different products, services, or scenarios, such as:

- 🛍️ Different products or price points

- 🎉 Special promotions or seasonal sales

- 🔄 Repeat buyers vs. new customers

- 🌎 Domestic vs. international shoppers

Customizing Offer Variables to Meet Your Needs

Your offer terms are fully adjustable and can be edited anytime. Here’s how to tailor them:

Down Payment:

- Want faster access to funds? Require more upfront.

- Want to drive volume? Go lower to reduce purchase hesitation.

Payment Frequency:

- Weekly,

- Biweekly,

- Monthly,

- Specific day(s) of the month.

Term Length:

- Short terms encourage faster turnover;

- Long terms make high-ticket items more accessible.

The Power of Flexibility

You can also offer customers flexibility within your payment plans, letting them choose terms from a range you set. This flexibility allows:

- Adjustable down payments

- Flexible payment frequencies

- Custom term lengths

- Personalized start dates

By allowing customers to select terms that fit their financial situation, you're more likely to close sales and reduce cart abandonment.

Automatic vs Manual offers

Partial.ly supports two types of offers:

Automatic Offers: These follow a fixed schedule. Once the plan is opened, Partial.ly automatically processes each payment based on the offer’s terms. Best for:

- 🔄 Recurring services

- 📅 Pre-orders with firm release dates

- 💳 Layaway programs

- ✈️ Scheduled events and travel

- 🧾 Collection payments

Manual Offers: These allow payments to be made manually at any time and in any amount until the balance is paid. Best for:

- 📦 Products with flexible or unknown delivery dates

- 🛠️ Projects or services with variable timelines

- 🕒 Customers who prefer full control over payment timing

Industry-Specific Offer Strategies: What Works Best

Businesses across industries are already growing with Partial.ly. Here’s how they’re using offers:

- Collectibles & Product Drops: Create plans with fixed due dates to ensure full payment before a release date—perfect for limited editions and pre-orders.

- Travel & Events: Require full payment 30 days before the trip or event while allowing flexible installment plans in the lead-up.

- Health & Wellness Services: Offer recurring payments for multi-session packages like therapy, coaching, or fitness training.

- Jewelry & High-Ticket Retail: Attract high-value customers with longer-term options and low down payments—without compromising cash flow.

Whatever your niche, Partial.ly lets you structure offers that feel custom-fit to your business and your audience.

How to Match Payment Offers to Customer Needs

To build offers that truly convert, it’s critical to understand your audience's needs and behaviors. Here’s how you could gather those insights:

Analyze Purchase History

Examine abandoned carts. Is there a price threshold where conversions drop? Offering payment plans at these points may boost sales.

Already using Partial.ly? Review your payment plan data to identify which terms resulted in completed payments and which led to defaults or cancellations.

Consider Your Customer Type

Are your customers price-sensitive or service-driven? Are they one-time buyers or long-term clients? Adjust terms based on their habits and expectations.

Test and Adapt

Offers can be modified at any time. Not seeing the results you want from a 3-month plan? Try offering a 6-month option and compare performance.

Rescue Offers

Partial.ly can automatically email a special offer to customers who abandon the Partial.ly checkout process, giving you another opportunity to provide payment terms that match their needs. If this rescue offer attracts more sign-ups, consider making it your primary offer.

Survey Your Customers

Ask directly. What payment frequency would they prefer? Would lower upfront costs increase their likelihood to purchase? Use customer feedback to guide your strategy.

Conclusion

Creating effective payment plan offers with Partial.ly means balancing your business’s needs with your customers’ expectations. By understanding your buyers, testing different strategies, and making use of Partial.ly’s flexible tools, you can craft payment plan offers that reduce cart abandonment, increase conversions, and improve customer loyalty.

Ready to create your first offer or improve your existing ones? Register now and start building your next best-seller—on your terms. Want to learn more? Schedule a demo with our sales team!