Designing payment plans with Partial.ly

Designing payment plans is a very interesting topic and it’s worth taking the time out to consider how best to do it.

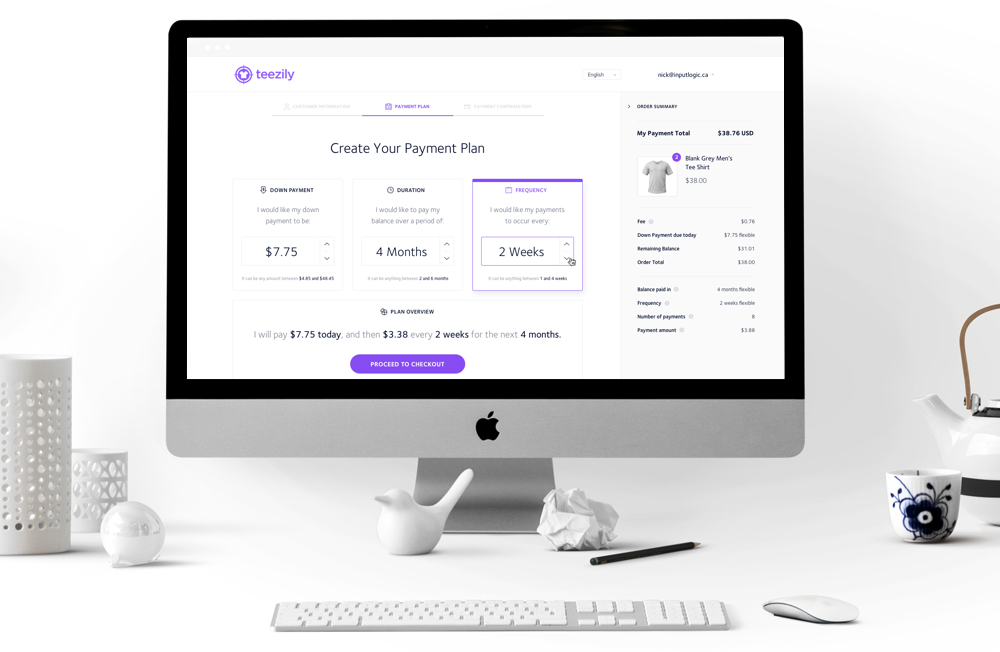

With Partial.ly, you as the ecommerce store owner set:

- Down payment

- Payment frequency

- Term

If you so wish, you also have the ability to make these customizable by shoppers within the limits that you want to set by setting customer flexibility parameters. You can also choose when to ship the products, such as after the 2nd installment has been received at the bank.

But, what's the best way to set up a plan?

It's all about risk

You have to think a bit like a bank. In short, it's all about financial risk and, as the ecommerce store owner, how much you are prepared to take on.

The risk revolves around how much needs to be received for the order before shipping.

In other words, if an item is listed at $200, how much of it needs to be paid before you are prepared to release the goods to the customer?

Minimizing risk from failed payments

Most people are risk averse, so a good way of approaching this is to not ship goods until the payments made cover your costs, typically this is buy price + shipping + handling + admin costs. This way, if a customer's automated payments are declined by the bank due to insufficient funds after the goods have shipped, you don't lose money.

Taking on more risk

If you think it adds value and enhances the customer experience, you might want to take on more risk for loyal, signed up customers with a track record of paying on time. So, you might consider releasing products for shipping before fully covering your costs, such as shipping after the down payment is received.

Where you think the increased risk might be worth it, consider how better payment terms to be provided to customers with a successful payment history would increase conversion rates and customer satisfaction.

Cash flow matters!

When shipping goods purchased with payment plans, cash flow needs to be properly considered. Cash flow directly determines how much working capital there is to purchase stock or pay bills and employees.

Payment plans create a steady, predictable income with forward visibility of projected revenue, but it's dynamic and changes from week to week as payment plans end and new plans are opened.

At scale, Partial.ly enables you to have hundreds or thousands of open payment plans at any time (it's better than having a much smaller number).

To recap:

Tip 1

- Consider how much risk you're willing to take on and covering your total costs before shipping

Tip 2

- Think about how taking on more risk might be utilized to drive sales

Tip 3

- Pay really close attention to your cash flow to make sure you have the working capital to run your business

Increasing ecommerce sales up to 100 percent with Partial.ly

Ecommerce stores using Partial.ly payment plans report increases of up to 100%, so sign up for Partial.ly today to start increasing sales and turnover on your ecommerce website.

Automated payment plans for ecommerce make it easy for online shoppers to buy big ticket items with installments while also simplifying collections for ecommerce stores by providing a streamlined, automated payment plan system.

Click here to sign up and let Partial.ly help you increase your ecommerce sales.